Our Experience Working with United Pilots and Families

Smith Anglin Financial is proud to work side-by-side with United and former Continental pilots. Our knowledge of your United Airlines retirement benefits, including the Pilot Retirement Account Plan (PRAP), A- Plan, B-Plan, and C-Plan allows us to help you make informed decisions regarding your financial future.

What You Should Know About Your United Airlines Pilot Retirement Benefits Plan

How to evaluate your United Airlines 401k’s investment options and their individual performance.

How to set up and utilize the Schwab PCRA investment options.

How to optimize your contributions to the Pilot Retirement Account Plan (PRAP) with the IRS limits.

Understand the 17% UAL contribution.

Determine your monthly payroll contribution % or $ rate.

How your profit-sharing affects your United Airlines PRAP.

How to manage your spill-over to your RHA and MBCBP.

How to manage your spill-over to your RHA and MBCBP.

How to forecast your taxes on your accounts.

How to take advantage of your In-Service Rollover Options available at 59.5 years of age.

How to roll over defined benefit pension plans such as your UAL A-Plan (PBGC), CPRP and/or CARP.

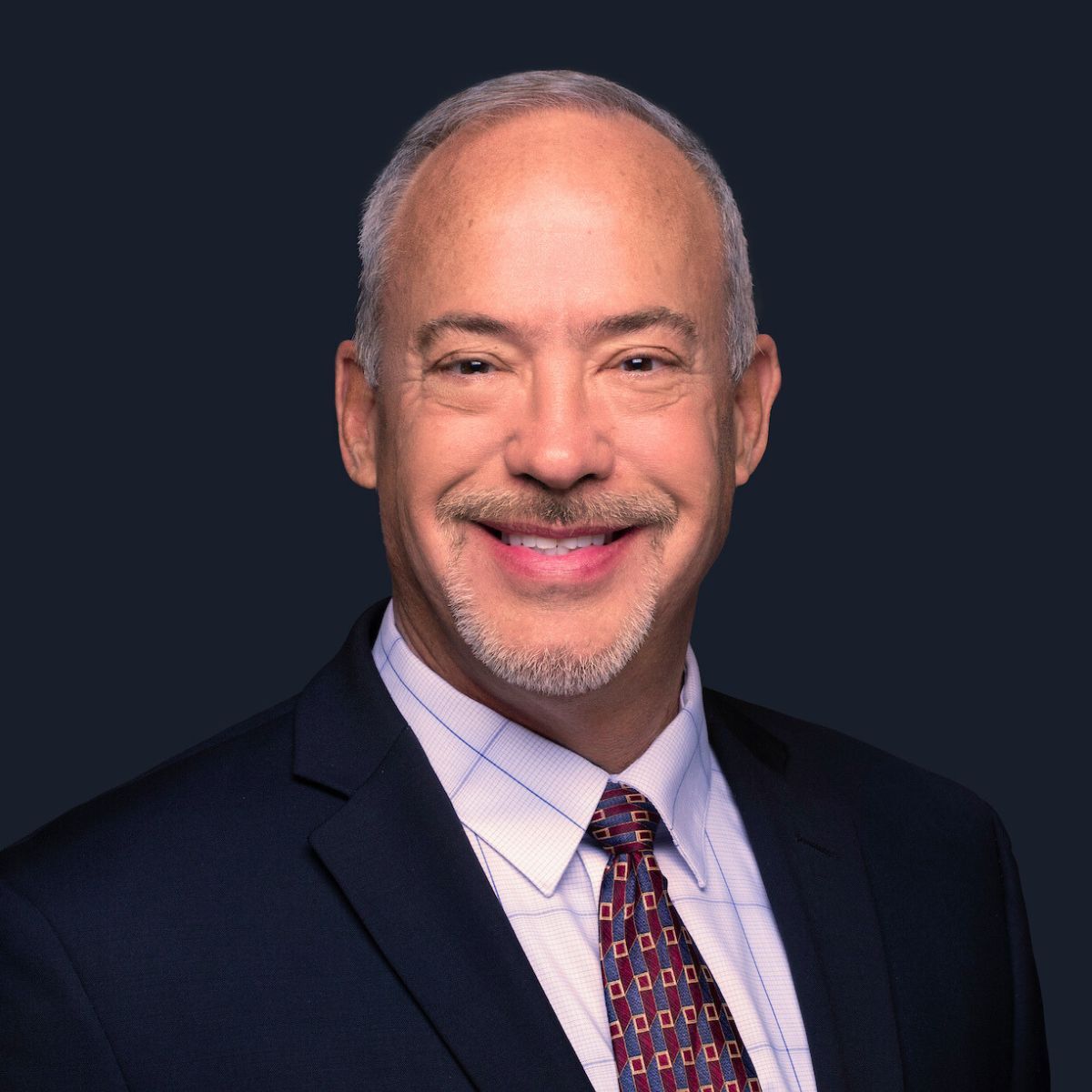

Your United Retirement Specialist

Wayne Worthington, CFA, CFP®

Senior Client Engagement Specialist

(319) 573-3079 Mobile

(972) 267-1244 Office

Request Your Complimentary Retirement Plan Analysis

For pilots who are nearing retirement. We can help utilize your company-provided benefits, assess the pros and cons of each major decision as it relates to your specific circumstances, and most importantly, create a plan to help accomplish what matters most to you – enjoying the retirement you have worked so hard for.

What you can expect to see in your personalized Retirement Plan Analysis:

Retirement Cash Flow Projection

Tax Impact Analysis

Investment Strategy Evaluation

Specific Scenarios for Your Situation

To get started, please complete the simple form below

401K AutoPilot℠ Program

For pilots who are ready to optimize their financial future. If you are a pilot with a 401k balance under $500k, our 401K Autopilot Program is the solution we’ve created to help optimize your financial future. Our team will help you navigate the ever-changing capital markets landscape and set up a financially savvy flight plan to help accomplish what matters most to you – building a more secure financial picture for all the years ahead.

To get started, please complete the simple form below

Request Your Complimentary Retirement Plan Analysis

For pilots who are nearing retirement. We can help utilize your company-provided benefits, assess the pros and cons of each major decision as it relates to your specific circumstances, and most importantly, create a plan to help accomplish what matters most to you – enjoying the retirement you have worked so hard for.

What you can expect to see in your personalized Retirement Plan Analysis:

-

Retirement Cash Flow Projection

-

Tax Impact Analysis

-

Investment Strategy Evaluation

-

Specific Scenarios for Your Situation

401K AutoPilot℠ Program

For pilots who are ready to optimize their financial future. If you are a pilot with a 401k balance under $500k, our 401K Autopilot Program is the solution we’ve created to help optimize your financial future. Our team will help you navigate the ever-changing capital markets landscape and set up a financially savvy flight plan to help accomplish what matters most to you – building a more secure financial picture for all the years ahead.

A long history of providing honest, compassionate, and informative service. Read what our clients are saying.

All testimonials are provided by current clients of Smith Anglin Financial. Clients were not compensated for testimonials, direct or otherwise. To our knowledge, no other conflicts of interest exist regarding these testimonials.

Request Your 401k Autopilot℠ Program Digital Brochure

If you are a pilot with a 401k balance under $500k, our 401K Autopilot℠ Program is the solution we’ve created to help optimize your financial future. Our team will help you navigate the ever-changing capital markets landscape and set up a financially savvy flight plan to accomplish what matters most to you – building a more secure financial picture for all the years ahead. To learn more, request your digital brochure today!

Recent Blog Posts

View AllContact Us

14755 Preston Road, Suite 700

Dallas, TX 75254

972.267.1244 local

800.301.8486 toll free

Check the background of this practice on FINRA's BrokerCheck.

About Smith Anglin Financial

Founded in 1967, Smith Anglin is a wealth management practice based in Dallas, Texas. As trusted financial stewards, we provide an elevated standard of care and manage over $1.9 billion in client assets* for a select group of pilots, families, individuals, and business owners in 48 states and abroad. With deep roots in accounting, tax planning and aviation retirement readiness, our mission is to conscientiously help secure the financial well-being of our clients over the course of their lives, working diligently to help them achieve their goals, dreams and financial security.

*Data current as of 6/16/2025

Stay current and informed!

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Hightower Advisors, LLC is an SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Securities offered through Hightower Securities, LLC, Member FINRA/SIPC. brokercheck.finra.org