Markets have been treated like a punching bag over the first half of the year, taking blow after blow from a host of issues. The utter collapse in commodity prices wreaked havoc across world markets that struggled to adjust to the rapid change. The surging U.S. dollar hurt large U.S. multinational companies who found it harder to sell their now more expensive goods and services in foreign markets. Divergent monetary policies between the U.S. and the rest of the globe has left investors worried about consequences. China’s economic slowdown and multiple market meltdowns continue to reverberate around the world as the globe’s second-largest economy struggles to grow as it has in the past. And there are other issues of impact as well: weakening corporate earnings, historically low bond yields, historically high levels of sovereign debt, seemingly all of Latin America in political and economic turmoil, Japan’s attempts to right itself with negative interest rate policies. The list is exhausting. And then there was Brexit just this month – the United Kingdom’s (U.K.’s) unexpected decision to leave the European Union (EU), which sent markets reeling.

First Half of 2016

Before we dive into the Brexit drama, let’s take a quick look at the major stock markets and bond indexes for June and the first half of the year. European large company stocks, as measured by the FTSE 100, are actually up 5.0% for the month of June and 8.0% for the first half of the year. The S&P 500 is up 0.3% for the month and 3.8% for the year. U.S. small company stocks, as measured by the Russell 2000, are down -0.1% in June but up 2.2% for the year. And the MSCI All Country World Index without the U.S. is down -2.5% in June and down -2.0% for the year. Interestingly Emerging Markets are up 3.3% in June and 5.0% for the year. Not surprisingly, the volatility index has climbed over the month of June after quieting down from a noisy January and February.

Bonds have been a welcome surprise this year. Going into the year, the consensus view was that bonds, already suffering from record low yields, would suffer even more from tightening monetary policy in the U.S. Add to the mix negative interest rate policies from the European Central Bank (ECB) and the Bank of Japan (BoJ), and the outlook for bonds got very muddied. It appears that the first half of 2016 has eased some of those anxieties as bonds have benefited from being the safer haven when compared to stocks, and negative interest rate policies have somewhat backfired so far. The Barclays Capital Aggregate Bond Index was up 1.8% in June and 5.3% for the year. High yield bonds were up 0.9% in June and 9.1% for the year. Global bonds were up 5% in June and 15.0% for the year.

Commodities and real assets have enjoyed some appreciation year-to-date as well. Oil prices have climbed by nearly 30%, and several factors play into this change: the dollar giving back some strength, fires in Canada interrupting supply, and the drop in rig count finally impacting oil inventories. There is still not much near-term clarity on the oil war between OPEC producers and the U.S. frackers and shale players. And this lack of clarity on top of heightened uncertainty and fear probably explains a lot of the 22.9% increase YTD in the price of gold. Gold ramped up almost 9.1% in June, and over half of that price change came after the U.K. referendum.

What is Brexit?

Well, maybe we should first go back to the beginning and answer the question, “What is the European Union?” Extreme nationalism greatly divided continental Europe during the first four decades of the twentieth century and culminated in World War II. After the war, European integration was seen as a means to bring together the countries and peoples of the area. This integration first started with a cooperative political community, and eventually, political cooperation translated to economic cooperation. Through various commissions, councils, and treaties, the EU came into being in 1993 and the Euro was adopted as its currency in 1999.

A political and economic entity like the EU—which oversees a vast geographic region and population—brings with it governance, rules, and regulations. Simply put, an EU member country concedes some of its sovereignty to join and remain in the group. Essentially, the U.K. was part of an exclusive club, and they paid monetary dues and were expected to follow the rules that govern all club members.

Fast forward to 2012 and Prime Minister David Cameron initially rejected calls for a referendum (a vote) on the U.K.’s membership in the EU. But later, in January 2013, Cameron gave into political will and announced that the government would, in fact, hold a referendum before 2017 in order to gauge public support. There were and are a number of questions from the U.K. people about the benefits they receive from membership, and ultimately they tie back to economics and politics. There are those who are unhappy with their economic situation who voted to leave, believing that EU membership was expensive and not worth the cost. The politics of the EU has been a long-standing issue in the eyes of some. Member countries essentially ceded some power in lawmaking to the EU, and the most contentious issue of late deals with immigration. With the Eurozone suffering from dismal economic performance, a lot of workers from less affluent EU countries have moved to the U.K. in search of work, and there is little the U.K. could do to control the influx of people.

All of this caused two camps to emerge: the Remain camp and the Exit (or Brexit) camp. Opinion polls in May had the vote near a 50-50 split, and that changed little leading up to the vote on June 24th. However, polling in that final week favored the Remain camp. U.K. betting houses had the Remain camp in the lead, forecasting about an 80% chance of winning, and this caused a lot of money to start flowing into stocks based on the expectation that the U.K. would vote to remain in the EU. While the results were in fact close, the Exit camp pulled off an upset, with 52% of U.K. voters casting their lot to leave the EU and only 48% voting to remain in the union. This surprise outcome sent markets into freefall. The FTSE 100 was down -5.6% at one point and the S&P 500 was sent down about -5.4%, but promises for a rate cut from the Bank of England helped world stocks reverse course and move higher. Central bankers continue to say and sometimes do whatever they can to save stocks.

What’s next?

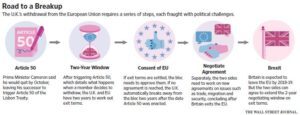

The fallout from the U.K.’s Brexit vote wasn’t seen only in the world’s capital markets, it sent tremors through the houses of power as well. U.K. Prime Minister Cameron, who campaigned for the U.K. to remain in the EU, announced that he would be resigning from office in the next few months and would not be the one to invoke Article 50 of the Treaty of Lisbon, which formally initiates the “exit” process for a departing EU member. This means the U.K.’s EU departure will be delayed. In fact, the exit itself will likely take two years to conclude, if not more. The U.K.’s exit from the EU isn’t really the biggest risk for Europe, the greater risk is the possibility of more EU countries following the U.K.’s playbook and holding referendums to exit themselves, which could cause the EU to be dismantled altogether. One would think that if you were an EU country considering an exit, you would wait and see how the U.K. exit works out before making the decision, but humans (and investors) are not always so rational.

So what do we know?

We know about the laundry list of social, political, and economic risks affecting the world’s capital markets right now and we also realize that headlines themselves can cause short-term shocks in markets. Just look at the Brexit vote last week and the market reaction. The U.S. stock market sold off more than 5% in two trading days, and then made it back to basically breakeven in the next three trading days – a round trip in one week! We also know that making an investment decision based on a coin flip outcome is no better than betting on red or black at the roulette table. The best path is to invest prudently using a disciplined approach to manage short-term risks while seeking long-term growth and income.

Well, the year is only half over and if you have “headline fatigue,” you may want to put in your mouthpiece. The stock market of July 2016 and the second half of the year still holds a lot in store. Be ready for big headlines involving the Summer Olympics in Brazil, the continued spread of the Zika virus, Puerto Rico’s debt crisis, the U.S. presidential election this fall, the U.K. prime minister election, and so on. But remember, it’s all just Noise. Sometimes you wonder if you should do something different ahead of the next big event, but guessing is tough (again, people are not always rational). It’s very easy to guess wrong, and it’s difficult to be consistently right. The days following the Brexit vote do tell you something very important. Stocks didn’t have to go very far down to find buyers. Don’t forget; there are two sides to every trade.