Our Experience Working with Southwest Pilots, Employees, and Families

Smith Anglin Financial is proud to work side by side with Southwest pilots to provide retirement benefits planning. We’re specialists in Southwest Airlines’ 401k investment options and the performance of those options within the employer-provided retirement benefits plan. We’re also specialists in managing the tax issues for your deferred compensation components.

What You Should Know About Your Southwest Pilot Retirement Plan

- Southwest Airlines’ Personal Choice Retirement Account (PCRA) is a managed brokerage account that resides within your 401(k) plan. It enables you to contribute retirement plan savings into an expanded range of investment choices. If managed properly, it can give you an incredible advantage when it comes to saving for retirement.

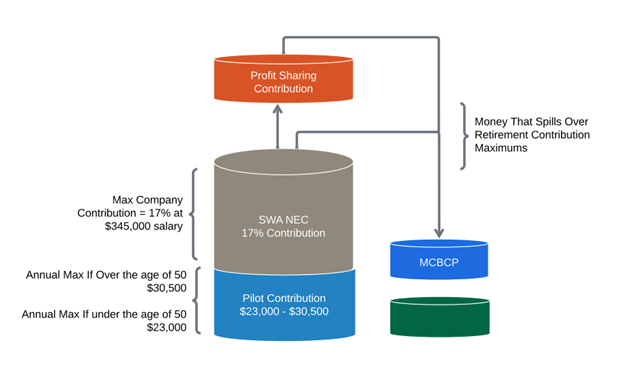

- A qualified plan is an employer-sponsored retirement plan that satisfies requirements I the Internal Revenue Code for receiving tax-deferred treatment. These plans provided by Southwest are: your 401(k), Profit Sharing, and Market Based Cash Balance Plan.

- A non-qualified plan is a type of tax-deferred, employer-sponsored retirement plan that falls outside of Employee Retirement Income Security Act of 1974 (ERISA) guidelines. These plans allow Southwest to defer a greater amount for retirement than is permitted inside a qualified plan: 401(a)(17), Excess 415 Benefit, and Top Hat Plan.

- When you enroll in these plans, you must elect how to receive the funds (as a lump sum or spread out over several years in installments). This decision is irrevocable, so you must plan wisely to avoid unnecessarily high tax payments.

- Southwest has a variety of retirement accounts that receive contributions from you and the company. Our team has a clear understanding of these accounts and will provide insight on how to maximize the contributions that flow into them.

- See the illustration below for more information.

- Open and contribute to IRAs, Roth IRAs

- Participate in company 401k plan

- Make use of PCRA sub-account

- Make maximum contributions

- Seek professional advice for investment and tax issues

- Begin making "catchup contributions" into 401k and IRA

- Rollover assets in 401k to IRA

- Rollover assets from ProfitSharing into IRA

- Transfer/Rollover remaining retirement assets to IRA

- Establish a financial plan for retirement

Financial Highlights of the 2024 Contract

Your Southwest Retirement Specialists

Discover Your Financial Journey

Helping Co-Pilot Your Financial Journey, No Matter Where You Are

Whether you’re nearing retirement or early in your career, we can help you better prepare for the path ahead.

Request Your Complimentary Retirement Plan Analysis

What you can expect to see in your personalized Retirement Plan Analysis:

- Retirement Cash Flow Projection

- Tax Impact Analysis

- Investment Strategy Evaluation

- Specific Scenarios for Your Situation

To get started, please complete the simple form below

401K AutoPilot℠ Program

To get started, please complete the simple form below

90% of Clients would Recommend Smith Anglin to Others.

Smith Anglin recently conducted a client survey aiming to enhance our service quality. We achieved a high 28% response rate, which according to the third- party survey vendor is significantly higher than the average response. The results showed that clients, on average, rated us an A.

Retired

5/17/2019

Active

12/6/2019

Active

12/18/2015

Active

3/22/2018

Retired

4/1/2013

Are You Ready For Retirement? [1:47]

Qualified vs. Non-Qualified Plans [3:19]

Learn About Your PCRA [2:32]

Southwest Pilots, You Took the Early Out. What Happens Now? [2:53]