2024 Economic Review and 2025 Outlook

2024 was a banner year for equity investors and the U.S. economy. Our condolences to the recession doomsayers, especially to the fixed-income bulls. We, too, were caught off guard by bond weaknesses, particularly given that the Fed has cut rates by 1% since September. Shouldn’t bond prices go up when the Fed cuts rates? Unfortunately, it’s not that simple.

To provide some context: The Federal Reserve controls the overnight lending rate but has limited influence over longer-term rates. These longer-term rates are more influenced by future inflation expectations, which have risen since September’s initial 50bps cut. Since the U.S. bond market is not short-term in nature, bonds have faced headwinds following a tough 2022 and 2023. U.S. economic resilience and persistent shelter/services inflation are to blame. In short, rate cuts are stimulative for growth, and growth tends to bring inflation. Paradoxically, this can push long-term interest rates higher—even when short-term rates are cut, a risk the Fed is acutely aware of.

So why did the Fed cut rates, given the economy remained healthy? The decision was a “head fake.” At the time, the unemployment rate had been rising sharply off a low base, signaling potential labor market weakness, which prompted the Fed to address its dual mandate: full employment. For context, a 0.5% rise in the 3-month moving average of the unemployment rate (the “Sahm Rule”) has always been a reliable recession predictor. However, the rise was a distortion, largely due to net immigration increasing the available labor force faster than job creation could keep up, compounded by undocumented employment. While the unemployment rate rose, it wasn’t driven by layoffs.

There were a few other data points that influenced the Fed’s decision, but as things evolved, labor market concerns faded, and inflation worries returned. This leaves us optimistic about a continued bull market for equities but with growing concerns for bonds as we move into 2025. This is a shift in tone compared to Q4 2023, when we initiated our one long-term bond position with the 10-year yield at 5%.

2024 Portfolio Playbook

Unlike 2023, when our models spent nine months of the year collecting the attractive 5% yield on liquid cash, much of which was borrowed from foreign equity exposure, 2024 was a year we deemed appropriate for being fully invested in stocks. Although U.S. large-cap stocks were expensive at the start of the year, their sustainable, high-quality growth helped offset weaknesses and volatility in foreign markets and bonds. Similarly, our tactical approach on the fixed-income side contributed positively to performance.

As a result, SAF models outperformed their respective Morningstar Target Risk Benchmarks across the board by 3-7%, depending on the allocation. Despite our ongoing overweight position in small/mid-cap value—an asset class that struggled in 2024—our selective approach and active management helped mitigate some of the performance drag seen in their passive indices. On the fixed-income side, we adjusted our strategy in July, adopting a more tactical posture by focusing on sectors with the best relative value and avoiding those with low yields and elevated interest rate risks. By mid-year, our fixed income portfolio captured an average yield to maturity of 7%, compared to the benchmark’s 4.5%, with similar credit risk and less duration. By year-end, we had a 2% lead over the Bloomberg U.S. Aggregate Bond Index.

Entering 2025, with inflation still above target, fewer rate cuts expected due to recent Fed guidance, and uncertainties surrounding Donald Trump’s tariff and immigration policies, we will take a more calculated approach. We’ll communicate more on this as we execute our first rebalance of 2025. Please contact your wealth advisor to learn more.

2024 Economy & 2025 Outlook

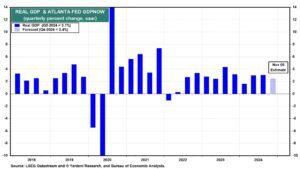

GDP growth seems to be re-accelerating. The real GDP growth for Q4 2024 is expected to be 3.1% over Q3.

After a slower start to the year, following a high base post-pandemic, concerns about exhausted cash savings were proven overly pessimistic. While discretionary goods spending has been weak, the U.S. remains a services-based economy, with services comprising over two-thirds of GDP. Despite the decline in stimulus savings, the wealth created over the past decade for older generations and tight labor markets have led to healthy real wage growth, mitigating many of the expected negative impacts.

As we enter 2025, we remain optimistic about the U.S. economy, especially with Trump’s pro-growth administration taking office. Small and mid-cap companies, which tend to be more correlated to domestic economic growth and deregulation, saw their share prices soar following the Republican sweep. SAF benefited greatly from its cyclical and small/mid-cap tilt. However, we remain cautious—markets often overestimate the impact of a new administration, and history shows that stock performance tends to be muted after a Republican sweep.

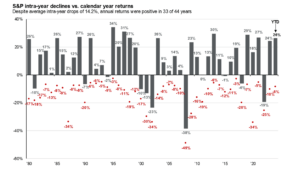

We anticipate some volatility or a mini correction in Q1 2025, as the market digests the potential impact of the Trump administration on an already strong economy. While this doesn’t warrant panic selling, we’ll use this opportunity to dial back risk in mid-cap equities by 3-8%, depending on the portfolio model, with the anticipation of re-entry sometime before the conclusion of Q1, possibly sooner. This is a normal occurrence within a long-term secular bull market. We see this as a potential buying opportunity, particularly with declining cash yields.

Positive and Negative Catalysts for 2025 Outlook

The following are key positive and negative catalysts that have emerged in 2024 and are likely to continue into 2025:

Positive Drivers:

1. Re-accelerating real GDP growth

2. Artificial Intelligence capital expenditures

3. Positive real wage/productivity growth

4. Re-accelerating corporate profits, including record profit margins

5. Pro-growth administration with stimulative economic policies

Negative Drivers:

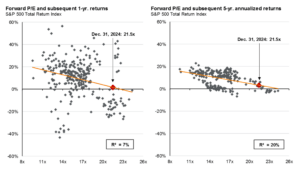

1. Elevated domestic stock market valuations

2. Elevated investor sentiment

3. Sticky shelter and services inflation, more restrictive monetary policy, and higher long-term rates

4. Elevated geopolitical risks (Russia/Ukraine, China/Taiwan, Iran)

5. Unpredictable administration policies (tariffs, immigration issues)

Despite the equal number of positive and negative factors, we believe the positives will outweigh the negatives as markets tend to prioritize economic growth. The risks tend to affect the bond market more than the equity market, which is why we’re taking a more tactical approach to fixed income. Although it’s rare to see three consecutive years of poor fixed-income performance, it’s not impossible. The inflationary periods during the 1970s and 1980s, driven by premature rate cuts and an oil crisis, serve as a historical example. Given the Fed’s rate cuts amid above-trend growth and a potential tariff war, there are parallels to that era.

We continue to believe fixed income offers value, but we are staying cautious, especially with long-duration bonds. Instead, we are re-allocating some of our long-duration exposure into a diversified basket of “liquid alternatives,” which offer low or negative correlation to equities, bonds, geopolitical events, and inflation. We expect these assets to provide more favorable returns than long-duration treasuries, with much less volatility.

Conclusion | 2025 Economic Outlook Playbook

In summary, we see 2025 as a continuation of the positive trends from 2024, but with a bumpier ride, particularly in Q1. After two strong years for equities and low volatility, stock returns may take a breather before continuing their long-term upward trajectory. The strength of the dollar, despite Trump’s intentions, will likely remain a headwind for foreign equities, especially if foreign governments attempt to weaken their currencies to offset the impact of tariffs on exports.

We are considering currency hedging our foreign equity exposure but remain cautious about eliminating the potential for long-term returns. The dollar has had a long run and is well above its long-term average strength, so there could be room for reversion.

In the meantime, we continue to favor U.S. stocks over foreign stocks and maintain a preference for higher-quality, stable-value companies within the small/mid-cap universe. We are dialing back cyclicality in mid-caps as we head into Q1 2025, anticipating the potential for a 10% drop in equities, before re-entering. We will also monitor elevated valuations in U.S. large-cap stocks, which could hurt long-term performance. (3)

Overall, we remain optimistic for the year ahead and look forward to providing more updates as 2025 progresses.

_______________________________________________

https://fred.stlouisfed.org/series/SAHMREALTIME

https://tradingeconomics.com/united-states/layoffs-and-discharges-total-nonfarm-rate-m-sa-fed-data.html

https://www.federalreserve.gov/newsevents/pressreleases/monetary20241218b.htm

https://www.atlantafed.org/chcs/wage-growth-tracker

https://www.nasdaq.com/articles/heres-average-stock-market-return-under-democratic-and-republican-presidents-hint-it-may

https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/